Unified Payments Interface (UPI) is a next-generation payments platform that facilitates instant transfer of funds from person to person and person to merchant using a smartphone. It powers multiple bank accounts into a single mobile application (of any participating bank), merges several banking features, seamless fund routing and merchant payments under one umbrella. It also caters to the‘Peer-to-Peer’ collect request which can be scheduled and paid as per requirement and convenience.

Manage

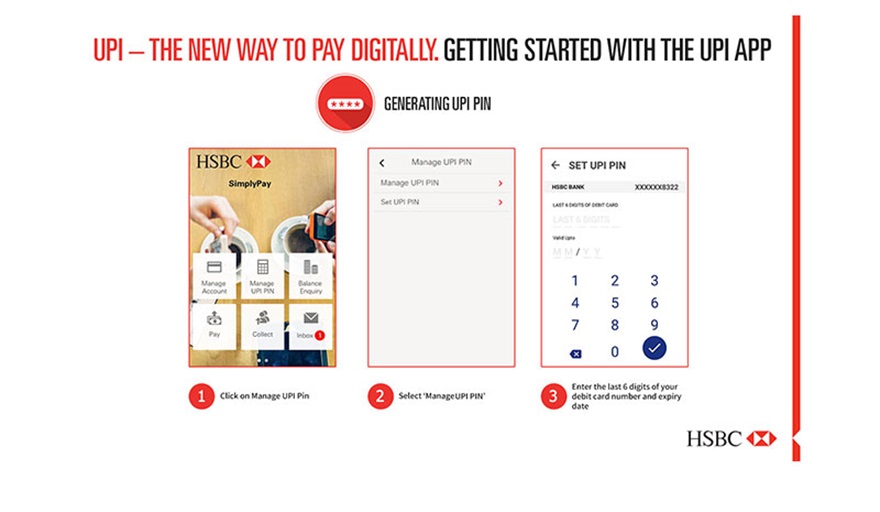

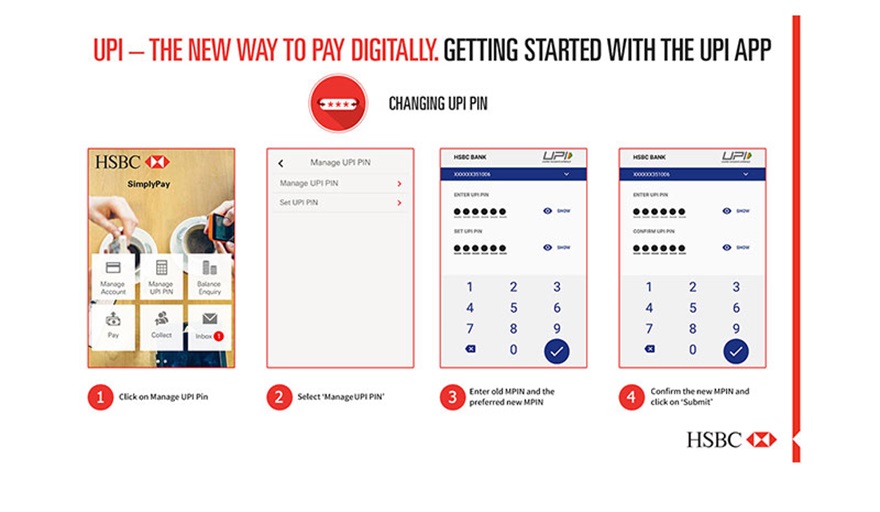

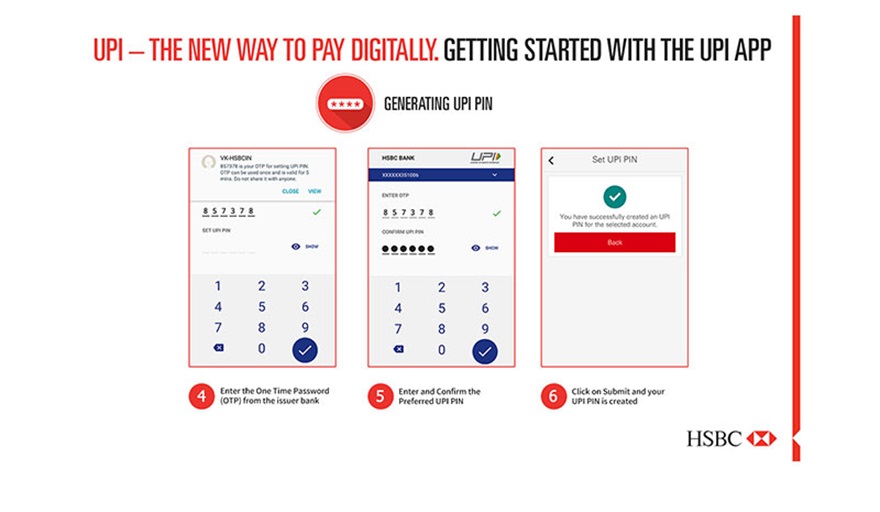

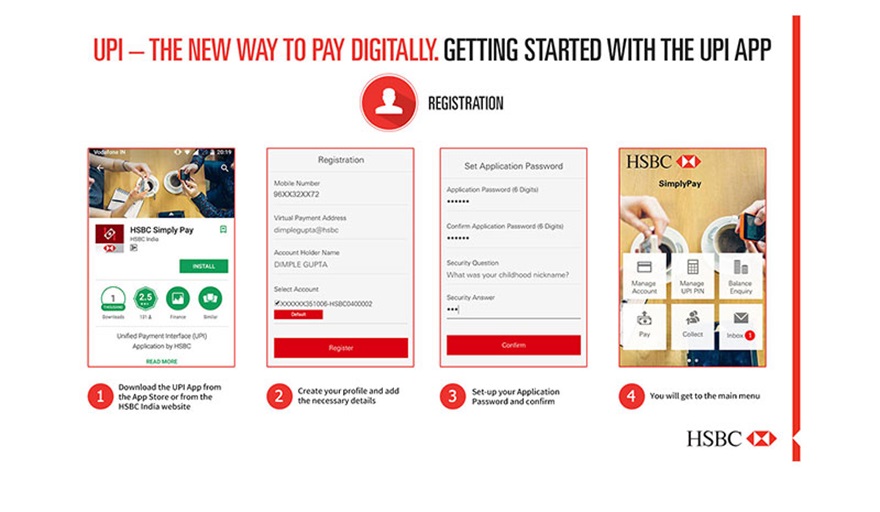

Unified Payments Interface (UPI)

You need strategies and solutions to help you navigate an uncharted environment.

Unified Payments Interface (UPI) is a next-generation payments platform that facilitates instant transfer of funds from person to person and person to merchant using a smartphone.

UPI Overview

How is it unique?

- Immediate money transfer through mobile device round the clock 24 x 7 and 365 days

- Single mobile application for accessing different bank accounts

- Single Click 2 Factor Authentication from security perspective yet provides for a very strong feature of seamless single click payment

- Usage of Virtual Payment Address (VPA) provides for incremental security. There is no need to enter the details such as card no. account number, IFSC, etc., at the time of transaction initiation or authorisation

- Payments can be done through any bank UPI App having accounts of multiple banks linked to the same UPI App

- Payments can be initiated from the customer or the merchant. Merchant initiated payments will appear as a collect request in the customer’s UPI App for authorisation

- Raising complaint/dispute from mobile app directly

MODES TO ACCESS UPI

Get in touch with us